Great product managers don’t just make decisions—they uncover insights that drive them!

To build successful products, you need a deep understanding of people: users, stakeholders, team members and the best way to achieve that? Mastering the art of interviewing!

Interviews help you gather customer feedback, align teams, and refine your product vision, but interviewing isn’t just about asking questions—it’s about uncovering what matters.

Why Interviews Matter in Product Research

Interviews are a cornerstone of qualitative research. They allow you to tap into real perceptions, attitudes, and experiences, but effective interviewing requires more than curiosity. You need to:

• Ask the right questions (and avoid the wrong ones).

• Create an environment where people feel comfortable sharing.

• Extract insights that lead to meaningful product decisions.

If you missed [Part I: User Interviews for PM's], check it out for guidance on interview types, when to use them, and how to prepare. Now, let’s dive into advanced techniques for better interviews.

The Challenges of Interviews

Interviews are powerful, but they have limitations:

When to Use Interviews

Interviews are best when you need to understand why people think, feel, or behave a certain way. They uncover perceptions, attitudes, motivations, and decision-making processes—insights that are hard to extract from analytics or surveys alone.

However, interviews rely on self-reported data, which isn’t always accurate. People often misremember past behavior, rationalize decisions after the fact, or tell you what they think you want to hear.

That’s why interviews are most effective when used in these scenarios:

- Early-stage product discovery - Understanding user pain points, unmet needs, and mental models.

- Feature validation - Exploring how users perceive and evaluate a concept before building.

- Understanding churn or adoption Learning why users do or don’t engage with a product.

- Stakeholder alignment Gathering internal perspectives to identify competing priorities.

When NOT to use interviews

If you need insights into actual behavior (rather than perceived behavior), interviews alone aren’t enough.

Consider these alternatives:

- Observation (Usability Testing, Diary Studies, Ethnographic Research) - When you want to see how people naturally interact with a product or environment.

- Behavioral Analytics - When you need quantitative data on what users are actually doing (e.g., tracking feature usage).

- A/B Testing - When you want real-world validation of preferences rather than opinions.

Interviewing Rules to Live By

To conduct meaningful interviews, follow these golden rules:

Probing Techniques for Deeper Insights

Great interviewers know how to dig deeper. Use these techniques:

• Silent Probe – After a question, wait 15 seconds. Silence encourages elaboration.

• Echo Probe – Repeat their last few words to prompt further discussion.

• Paraphrasing – Restate their answer to confirm understanding.

• Tell Me More – Use prompts like “Can you expand on that?” "Anything else" to go deeper.

Recruiting the right participants means success

Recruiting the right participants is the foundation of successful user research. If you’re talking to the wrong people, your insights won’t reflect reality—and worse, you might make product decisions based on misleading data. Imagine designing a product for sports fans but only interviewing people who hate sports. That’s how easy it is to go off track if your participant selection isn’t intentional. So, how do you ensure your research participants truly represent your target users?

Step 1: Define Your Ideal Participant

Demographics alone aren’t enough. Instead, focus on behaviors, motivations, and past actions.

For example, if you’re researching a premium next-day fashion delivery service, your ideal participants should be:

✔️ Buying clothes online at least once a month

✔️ Following fashion influencers on social media

✔️ Previously subscribed to a premium shopping service

Step 2: Find the Right Participants

Recruitment Methods

1. Recruitment Agencies – Quick but expensive ($150++ per recruit).

2. Automated Platforms – Faster but may attract “professional testers.”

3. Internal Customer Panels – Cost-effective but lacks diversity.

4. Online Communities – Engaged users but requires manual effort.

5. Website Pop-ups & Emails – Targets existing users but excludes new ones.

Step 3: Use a Screener Survey

Filter out the wrong participants by focusing on actions, not opinions.

✅ Ask “Have you paid for a premium shipping service in the past 6 months?” instead of “Would you pay for next-day shipping?”

✅ Use open-ended questions to detect cheaters (e.g., “What brands do you wear most often?”).

✅ Avoid leading questions that influence responses.

Step 4: Offer the Right Incentives

Match the incentive to the effort required:

💰 Cash ($50-$200)

🎁 Gift Cards

🛍️ Discounts

👕 Swag

Check ethical guidelines in your industry before offering payments.

Step 5: Ensure Inclusivity

To get truly diverse insights, recruit:

♿ Users who rely on assistive technologies

📱 Screen reader and voice navigation users

🖥️ People with color blindness, dyslexia, or motor impairments

Include accessibility needs in your screener survey.

Step 6: Start Early & Plan for No-Shows

Recruitment takes longer than expected. 10-20% of participants won’t show up.

💡 Pro Tip: Over-recruit slightly (if you need 10 participants, aim for 12).

Final Thoughts: Quality Participants = Quality Insights

The success of your user research hinges on talking to the right people.

✅ Define participant criteria based on behavior, not just demographics.

✅ Use multiple recruitment channels to get a diverse pool.

✅ Screen participants carefully to ensure they match your ideal user.

✅ Offer the right incentives to attract engaged participants.

✅ Start early and over-recruit to account for dropouts.

REMOTE INTERVIEWING: WHAT TO CONSIDER

Virtual interviews are common nowadays, especially after covid. They are obviously convenient, but do come with challenges so make sure to:

1. Choose the Right Format

• Video calls allow for non-verbal cues but respect participants’ preferences—some may prefer voice-only.

• Ensure they’re comfortable with the platform (Google Meet, Zoom, etc.) and send detailed instructions in advance.

2. Overcome Remote Challenges

• Technical Issues – Use reliable tools that don’t require installation.

• Building Rapport – Use body language and eye contact to create a connection.

• Poor Connectivity – Have a backup plan in case of internet issues.

By being aware of the challenges that you can face in interviewing; you can prepare for them. Follow the 6 rules and lean into the probing techniques to create space for great interviews to take place. By taking a strategic approach to recruitment, starting early, screening carefully, with diverse perspectives, you’ll collect more accurate, actionable insights—and ultimately, build better products that deliver on your outcomes.

When conducting user research, one of the most common questions product managers ask is: How many participants do I need?

The answer depends on whether you're conducting qualitative or quantitative research and what level of confidence or insight you're aiming for.

In this article, we'll break down the basic concepts of sampling, statistical significance, and saturation, helping you determine the right number of participants for your study.

Qualitative vs. Quantitative Research: Different Approaches to Sampling

The number of participants you need is largely dictated by the type of research you're conducting:

- Quantitative research aims for generalisability, meaning its findings should be representative of a larger population. To achieve this, you need a large sample size and use probability sampling—where participants are randomly selected to avoid bias.

- Qualitative research is more about deep insights from a specific user group. Rather than large numbers, qualitative research uses non-probability sampling, selecting participants based on specific characteristics that align with the research goals.

For example, if you’re trying to understand why people over 35 aren't using your mobile app, you wouldn’t randomly recruit participants of all ages. Instead, you’d specifically select smartphone owners over 35 who know about the app but don’t use it, with behaviours and motivations you are interested in exploring further.

Understanding Validity: Statistical Significance vs. Saturation

Research validity is about ensuring your findings truly reflect user behavior. But how you achieve validity differs between quantitative and qualitative research.

For Quantitative Research: Statistical Significance

Quantitative research relies on statistical significance—a measure that tells us whether a result is real or just due to chance. Achieving statistical significance requires a large sample size. Generally, the larger the sample, the more reliable the data. You will also need to identify your hypothesis, both null & alternative, then choose your significance level, a common choice is 0.05 (5%), meaning there's a 5% chance the result is due to random variation rather than a true effect. You will then need to analyse your data, e.g., a T-test for comparing two group means; such as an AB test comparing old design to new design and then calculate your p-value, which tells you how likely your observed results occurred by chance. For example, if your A/B test shows p = 0.03, then there is a 3% chance the observed difference is due to randomness, which is below the 5% threshold—so you can conclude the new design significantly improves performance.

If you are lucky enough to have data scientists that you can work with, then you, the designer, lead engineer (at the very least) should all partner together to debate all of this through and align.

For Qualitative Research: Saturation

Unlike quantitative research, qualitative studies don’t aim for statistical significance. Instead, they use the concept of saturation—the point at which additional participants stop providing new insights. Once you reach saturation, you can be confident that you’ve gathered enough data for meaningful conclusions.

The number of participants needed to reach saturation depends on the research method:

- Usability Testing: Studies suggest that 5 participants per round uncover about 85% of usability issues. Testing with 15 users in a single round can reveal nearly all issues, but a better approach is to run three rounds with 5 users each, iterating and improving after each round.

- User Interviews: Because interviews are open-ended and explore experiences and motivations, saturation often occurs after 12-20 participants, depending on the number of distinct user personas and the complexity of the research questions. Conducting research in multiple rounds (e.g., three rounds of 5-7 participants) allows you to refine questions and focus on gaps.

Special Considerations: When You Need More Participants

While these general guidelines work in most cases, some situations require a larger sample:

- Diverse User Groups: If your product serves very different user segments, you may need 5+ participants per group to ensure each perspective is captured.

- Safety-Critical Products: For medical devices, cars, aviation systems, or anything where usability failures could result in harm, testing should go beyond 5 users per round.

- Highly Variable Responses: If early research suggests a high degree of variability in user behavior or opinions, increasing the sample size may help in detecting meaningful patterns.

A Smarter Approach: Iterative Research

Instead of front-loading research with a large sample size, a smarter approach is to conduct research in iterative rounds.

For example:

- Start with 5 usability test participants and analyze results.

- If new issues continue to emerge, test with 5 more.

- If you reach saturation (no new insights), shift focus to improving the product based on findings.

For interviews, begin with 6-8 participants and evaluate whether new themes are emerging. If insights are still evolving, continue with additional rounds.

Conclusion: Right-Size Your Research for Impact

The right number of participants depends on your research goals:

- Quantitative research needs large numbers (often 100+) to achieve statistical significance.

- Qualitative research relies on smaller, focused samples (often 5-20) to reach saturation.

- Usability tests typically use 5 participants per round, while interviews require 12-20 depending on complexity.

User research isn’t about hitting a magic number—it’s about ensuring you gather enough reliable insights to make better product decisions. Keep your research iterative, adjust as you go, and let your findings guide the next step.

What’s been your experience with determining the right sample size for research? Share your thoughts in the comments!

Interviewing is one of the most powerful tools in a product user researcher's toolkit, if not the most powerful tool! Together with observation, it forms the foundation of qualitative research, allowing us to uncover deep insights into user needs, behaviors, and motivations.

While anyone can conduct an interview with a bit of training, becoming a great interviewer requires practice, skill, and a deep understanding of the different interview techniques. As Steve Portigal, a leading expert in user research, puts it: To interview well, one must study. I would also add that you want to lean into your partnership with the designers. They have in depth knowledge in this area and the more you partner with them, the better your own skills will get.

I guess my intention with this light guide, is to explore different types of interviews, their role in the product development process, and key strategies you can use for preparing and conducting effective interviews that yield meaningful insights. A beginners guide for PMs so to speak.

Types of Interviews and When to Use Them

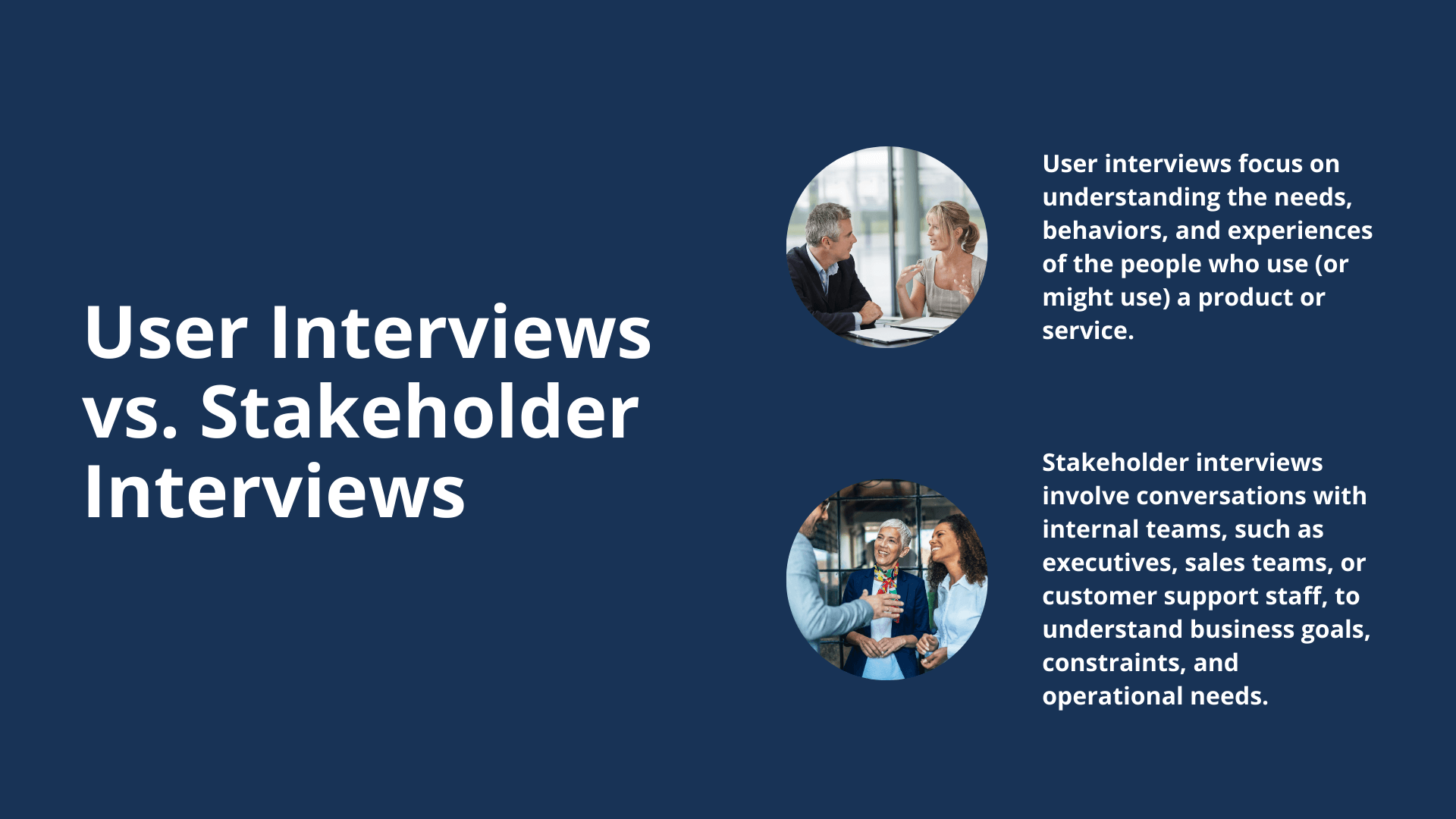

Interviews can be classified in different ways depending on their purpose and level of structure, however, in this guide, we'll focus on user interviews, but the principles also apply to stakeholder interviews as well.

The Interview Spectrum: From Structured to Informal

Interviews exist on a spectrum of formality, ranging from highly structured to completely informal. The right approach you choose depends on the research goal.

1. Structured Interviews

Follow a fixed set of questions always asked in the same order with each participant. They provide standardized responses, making them easier to analyze after you are complete. They are also useful when comparing answers across many participants (e.g., usability studies).

Research Goal: Validate a hypothesis about customer behavior

Example: A product team wants to understand how often small business owners use a new invoicing feature and what challenges they face.

Choice Rationale:

Example: A product team wants to understand how often small business owners use a new invoicing feature and what challenges they face.

Choice Rationale:

- A structured interview ensures consistency across respondents, making it easier to compare answers.

- If the goal is validation, we need quantifiable insights, which structured interviews provide.

- Questions are predetermined, reducing bias and allowing for statistical analysis.

When to Use:

- When looking for quantitative validation

- When a hypothesis needs a clear yes/no or scaled responses

- When conducting large-scale interviews where uniformity is key

2. Semi-Structured Interviews (Most Common)

You will have to have a prepared set of topics but it should allow flexibility in how questions are asked, which should then enable a deeper exploration of unexpected insights that might come up in the interview. This approach is ideal for early-stage discovery research.

Research Goal: Explore user pain points and motivations

Example: A team is exploring why customer retention has dropped after onboarding.

Choice Rationale:

Example: A team is exploring why customer retention has dropped after onboarding.

Choice Rationale:

- We need some structure to ensure we cover key themes (onboarding experience, drop-off points, customer expectations).

- However, we also want flexibility to follow unexpected insights or user emotions that emerge.

- It allows for pattern recognition while leaving space for discovery.

When to Use:

- When researching customer experiences, pain points, or motivations

- When there's an exploratory component but we still need some structured comparison

- When we have some hypotheses but want room for deeper insights

3. Unstructured Interviews

With these types, you will have no predefined questions; instead, the interviewer guides the conversation based on the participant responses and it goes where it goes. These are used for exploratory research when little is known about the problem space and are especially useful early on in the endeavour.

Research Goal: Discover unmet needs and opportunities

Example: A startup is developing a new personal finance app but isn't sure what features would provide the most value to users.

Choice Rationale:

Example: A startup is developing a new personal finance app but isn't sure what features would provide the most value to users.

Choice Rationale:

- The team doesn’t know what it doesn’t know, so a highly exploratory approach is needed.

- Open-ended conversations allow the customer to lead the discussion, revealing unexpected behaviors, mental models, or pain points.

- It’s useful in the early discovery phase before hypotheses are formed.

When to Use:

- When the goal is to uncover opportunities, not validate ideas

- When entering a new market or product space

- When needing deep, qualitative insights

4. Informal Interviews

These often resemble natural conversations rather than formal interviews and are useful for capturing organic insights in real-world settings, e.g., chatting with users at a coffee shop, or chatting with your engineers to understand more about the tech stack or tools they use.

Research Goal: Gather contextual, in-the-moment insights

Example: A team working on a food delivery app overhears customers discussing delivery delays at a café and decides to have casual conversations with them.

Choice Rationale:

Example: A team working on a food delivery app overhears customers discussing delivery delays at a café and decides to have casual conversations with them.

Choice Rationale:

- The goal is quick, contextual feedback, rather than a formal research session.

- Informal settings reduce response bias—customers speak more naturally.

- It’s a lightweight way to sense-check ideas or assumptions without setting up formal interviews.

When to Use:

- When needing quick, in-the-moment feedback

- When engaging in contextual inquiries (e.g., observing users in their environment)

- When looking for spontaneous, natural reactions

Summary of How to make the Choice

The interview type depends on:

- Research goal – Are we validating, exploring, discovering, or gathering context?

- Level of structure needed – Do we need comparable answers (structured) or deep insights (unstructured)?

- Stage in product development – Early-stage research benefits from unstructured or semi-structured interviews; validation calls for structured ones.

- User mindset – If we need unbiased, natural responses, informal interviews work well.

- Ask a Designer - always partner with your designer as they are steeped in this knowledge

When to Use Interviews

Interviews are versatile and can be used at various stages of product discovery and development:

- Discovery phase: Identify pain points, reframe the problem, and uncover unmet needs.

- Ideation phase: Validate early concepts and refine ideas.

- Redesign phase: Gather feedback on an existing product or service to improve usability.

However, interviews have limitations. They capture what people say, not necessarily what they do. If you need behavioral data, observational methods, such as usability testing, are more reliable.

Preparing for a User Interview

1. Define Your Research Goals: Before conducting interviews, clarify your research objectives:

- What do you want to learn?

- How will the insights inform your design decisions?

A clear research goal ensures you ask the right questions and stay focused.

2. Create a Discussion Guide: A discussion guide helps structure the conversation while allowing flexibility. It should include:

- Key themes or topics to explore.

- Open-ended questions (e.g., "Can you describe a time when?" instead of "Do you like this?").

- Follow-up prompts to encourage deeper responses.

Example: Instead of asking "Do you like ice cream?", ask "Can you describe your favorite ice cream and why you like it?" The latter elicits richer, more detailed responses.

3. Structure Your Questions Thoughtfully

- Start with general questions to ease the participant into the conversation.

- Move to specific questions that require deeper reflection.

- Save sensitive or challenging questions for later when rapport is established.

4. Conduct a Brainstorming Session (For Teams): If working in a team, collaboratively brainstorm potential topics and questions:

- Write down the research goal.

- Have team members generate possible questions on sticky notes.

- Group similar themes and prioritize key topics.

This process ensures the discussion guide aligns with diverse perspectives and business needs.

5. Consider Interview Logistics

- Duration: 45-60 minutes (longer interviews can be split into multiple sessions).

- Setting: In-person, remote, or contextual (in the users natural environment).

- Recording & Notes: Get permission to record the session for accurate analysis.

Avoiding Common Interview Pitfalls

1. The Accuracy Problem: People don't always recall past actions accurately or predict future behavior reliably.

Example: Asking "Would you use this product?" often yields misleading answers. Instead, ask about past behavior: "Can you describe the last time you faced this problem?"

2. Response Biases

- Deference Effect: Participants may tell you what they think you want to hear.

- Social Desirability Bias: They may give answers that make them look good rather than truthful responses.

Mitigation Strategy: Build trust, remain neutral, and phrase questions carefully to reduce bias.

3. Leading Questions: As an interviewer you want to avoid questions that suggest an answer.

- Leading: "How much do you love this feature?"

- Neutral: "What do you think of this feature?"

Final Thoughts: Mastering the Art of User Interviews

User interviews are an essential tool for product managers, designers, engineers and researchers looking to build user-centric products. When done well, they provide deep insights into user needs, experiences, and pain points.

To conduct effective interviews you need to choose the right interview type based on your research goals. You will also need to prepare a strong discussion guide with open-ended questions and be mindful of biases and response effects. Lastly, make sure to analyze responses critically & focus on what users do, not just what they say. To do this, you want to make sure you deeply partner with your design person; that relationship between product and design should be tight with daily interaction, debate and planning and one hopes that lead engineer is part of that daily interaction, thigh deep in the discovery with you.

By refining your interviewing skills, you'll uncover powerful insights that drive better product decisions and create experiences that truly resonate with users.

Personal integrity is the foundation of trust—both in life and in business. It means staying aligned with your values, doing what’s right even when no one is watching, and standing for something bigger than yourself. True integrity isn’t just about avoiding unethical behaviour; it’s about actively choosing to be a force for good. When we commit to integrity, we uphold honesty, fairness, and accountability—not just for ourselves, but for the people and communities we serve.

This same principle applies to product management and research. Ethical decisions aren’t always the easiest or the fastest, but they are the ones that create lasting impact. Being of service to users means looking beyond engagement metrics and business goals to consider the real-world consequences of what we build. It requires asking hard questions, challenging assumptions, and advocating for what’s right—even when it’s inconvenient. When product leaders and researchers operate with integrity, they don’t just create successful products; they build solutions that genuinely improve lives.

Ethics in Product Management: A Strategic Advantage

Ethics in product management aren’t just safeguards; they are often a strategic advantage. In the rush to deliver and scale, ethical considerations—especially the question of should we—often get sidelined. However, failing to address ethical risks early can backfire, leading to loss of trust, legal repercussions, and damage to brand reputation.

Embedding Ethics in Vision & Strategy

Vision and strategy workshops, where as a team you should be debating the strategy, are critical moments to define ethical boundaries. The key question every product manager should ask is: What are the unintended consequences of what we’re building? Could an algorithm reinforce bias? Does a feature encourage compulsive behaviour? Is a monetisation strategy exploiting vulnerable users? These are not abstract concerns—they have tangible effects on trust, reputation, and long-term success.

Consider these cautionary examples where they did exactly that:

- Amazon’s AI Hiring Bias (2018) – Amazon developed an AI-powered recruitment tool designed to automate hiring. However, the system was found to be biased against women because it was trained on past hiring data, which favoured male candidates. The tool penalised resumes that included terms like women’s chess club or graduates from all-women’s colleges. Amazon ultimately scrapped the system, highlighting the risks of unchecked AI bias.

- Apple’s iPhone Performance Throttling (2017) – Apple admitted to secretly slowing down older iPhones through software updates. While the company claimed this was to prevent unexpected shutdowns due to ageing batteries, many users saw it as a tactic to push them toward upgrading to newer models. Apple faced global backlash and lawsuits, forcing them to offer discounted battery replacements and greater transparency on iPhone performance management.

- Google’s Project Dragonfly (2018) – Google secretly developed a censored search engine for the Chinese market that suppressed results on sensitive topics like human rights and democracy. When exposed, the project sparked massive backlash from employees, activists, and human rights organisations. Critics argued that Google was compromising its ethical standards for market access. Due to the controversy, the project was ultimately shelved.

Ethical product development isn’t a one-time discussion; it’s an ongoing commitment that starts in Vision & Strategy debates. Building ethical checkpoints into every stage is critical. When setting the vision, ask: Are we solving the right problem in the right way? In strategy debates, challenge assumptions: What happens if this scales beyond our control? What are the downstream impacts?

Prioritising ethics doesn’t slow innovation—it strengthens it. When ethics are embedded, teams create solutions that drive impact while upholding trust, inclusivity, and long-term sustainability. Consider Patagonia’s commitment to sustainability: by embedding environmental ethics into its business strategy, Patagonia built a strong brand identity that led to customer loyalty, premium pricing power, and a lasting competitive advantage.

Ethical Research: Respecting Participants’ Rights

Product research should inherently include ethical considerations, but it requires conscious effort to go beyond usability and engagement metrics. Ethical research seeks diverse perspectives, uncovers potential harm, and establishes accountability.

Imagine signing up for a research study expecting a simple experience, only to be bombarded with intrusive questions, uncertain about where your data will end up, and pressured to continue even if you’re uncomfortable. Would you feel respected? Probably not—but unethical research practices like these happen all too often.

A stark example is Facebook’s Emotional Contagion Experiment (2012). Nearly 700,000 users had their News Feeds manipulated to show either more positive or more negative posts, measuring whether this influenced their own emotional expressions. The study sparked outrage due to its lack of transparency, failure to obtain informed consent, and potential emotional harm to users.

These cases highlight how unethical research can damage both user trust and company reputation. As a researcher, every interview, survey, or usability test you conduct is an opportunity to lead with integrity—or to erode trust. Ethical research isn’t just a best practice; it’s a leadership standard that sets visionary product professionals apart.

The Five Fundamental Rights of Research Participants

Ethical research begins with protecting participants. Every product leader and researcher should uphold these five core rights:

- The Right Not to Suffer Harm – Participants should never leave a research session feeling worse than when they entered. Harm isn’t always physical—it can be emotional, financial, social, or psychological. Thoughtful, ethical questioning is key to protecting them while gathering valuable insights.

- The Right Not to Participate – True insights come from willing participants. No one should feel pressured to take part. Informed choice creates better data—and stronger relationships.

- The Right to Give Informed Consent – Transparency builds trust. Participants must understand the purpose of the research, how their data will be used, and their right to withdraw. Burying this information in fine print isn’t ethical.

- The Right to Anonymity – Research findings should protect participants’ identities, particularly for sensitive topics. Anonymity fosters honest responses and trust.

- The Right to Confidentiality – Research data must be securely stored and handled responsibly. A breach of confidentiality can damage reputations, careers, and businesses.

A Researcher’s Roadmap: Planning with Ethics in Mind

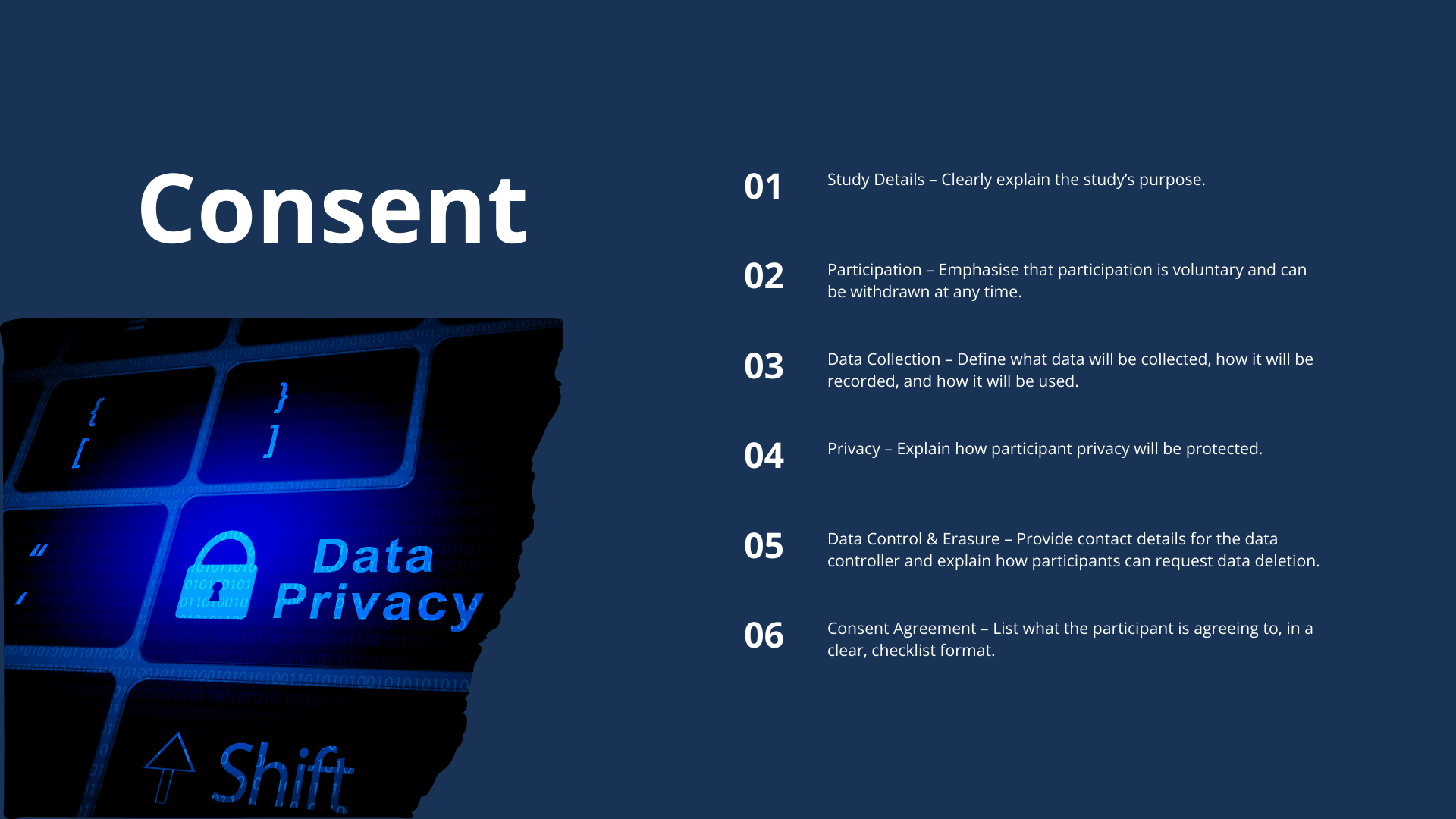

Respecting these rights starts with careful planning, beginning with a well-structured consent form. Here’s how to build one:

For research involving minors, parental or guardian consent is required. Be mindful that age-of-consent laws vary by country, so always check regulations, especially for global enterprises.

Why This Matters for Leaders & Product Managers

Leading ethically isn’t just about avoiding legal trouble—it’s about setting a higher standard. Ethical leadership ensures that:

✅ Customers, employees, and stakeholders trust your’e organisation.

✅ Participants feel safe, encouraging honest feedback.

✅ Data quality improves, leading to better product decisions.

✅ Your brand reputation remains strong, especially in industries with high data sensitivity.

✅ Participants feel safe, encouraging honest feedback.

✅ Data quality improves, leading to better product decisions.

✅ Your brand reputation remains strong, especially in industries with high data sensitivity.

Lead with Ethics, Lead with Vision

Visionary product leaders don’t just ask questions—they earn trust. Ethical research and decision-making are not burdens; they are opportunities to build lasting relationships, uncover richer insights, and drive meaningful impact.

If you’re ready to elevate your product leadership, master ethical decision-making, and build research-driven strategies that inspire and innovate, join my coaching program, Transformative Visions. Let’s redefine leadership—one ethical decision at a time.

When done right, product research can be one of the most powerful tools in building successful products. However, without a structured approach, research can become fragmented, inefficient, lengthy or even misleading.

This is why I think it is so important for product managers to be involved, along with the lead engineers, both of whom should deeply partner on research; it’s not just a Design function and you definitely don't want to be pitching it over the fence at them. A well-structured and research plan aligns teams, ensures the right questions are being asked, leads to insights that drive product decisions and should deliver on the strategic goals the team is working on.

Whether you’re new to research, looking to learn more, or looking to refine your approach, this guide will help you plan and execute user research effectively. So let's walk through what a research plan is and why it’s important.

Why Do You Need a Research Plan?

A research plan is a blueprint for conducting user research. It outlines your objectives, methodology, logistics, and deliverables, ensuring everyone is aligned before the research even begins. A well-thought-out research plan:

Key Components of a Research Plan

When starting any new research project, the plan not only outlines why you do the research, but also how you're going to do it. There is no universal research plan template, but a strong plan typically includes these core sections:

1. High-Level Project Details

In this section you'll include the start date of the project, the key stakeholders involved, and details of who will be responsible for reviewing and signing off on the research. If required, the background section should outline why you're doing the research and provide any additional information for the context of the project.

2. Research Objectives and Questions

Next, you'll have a research objective and question section. Before diving into research, you need to clearly define:

- Research Objectives: What do we need to learn? (e.g., “Understand why users abandon the onboarding flow”)

- Research Questions: What specific questions will we ask? (e.g., “What pain points do users encounter in the onboarding process?”, "Where do users drop off")

3. Methodology: How Will We Conduct the Research?

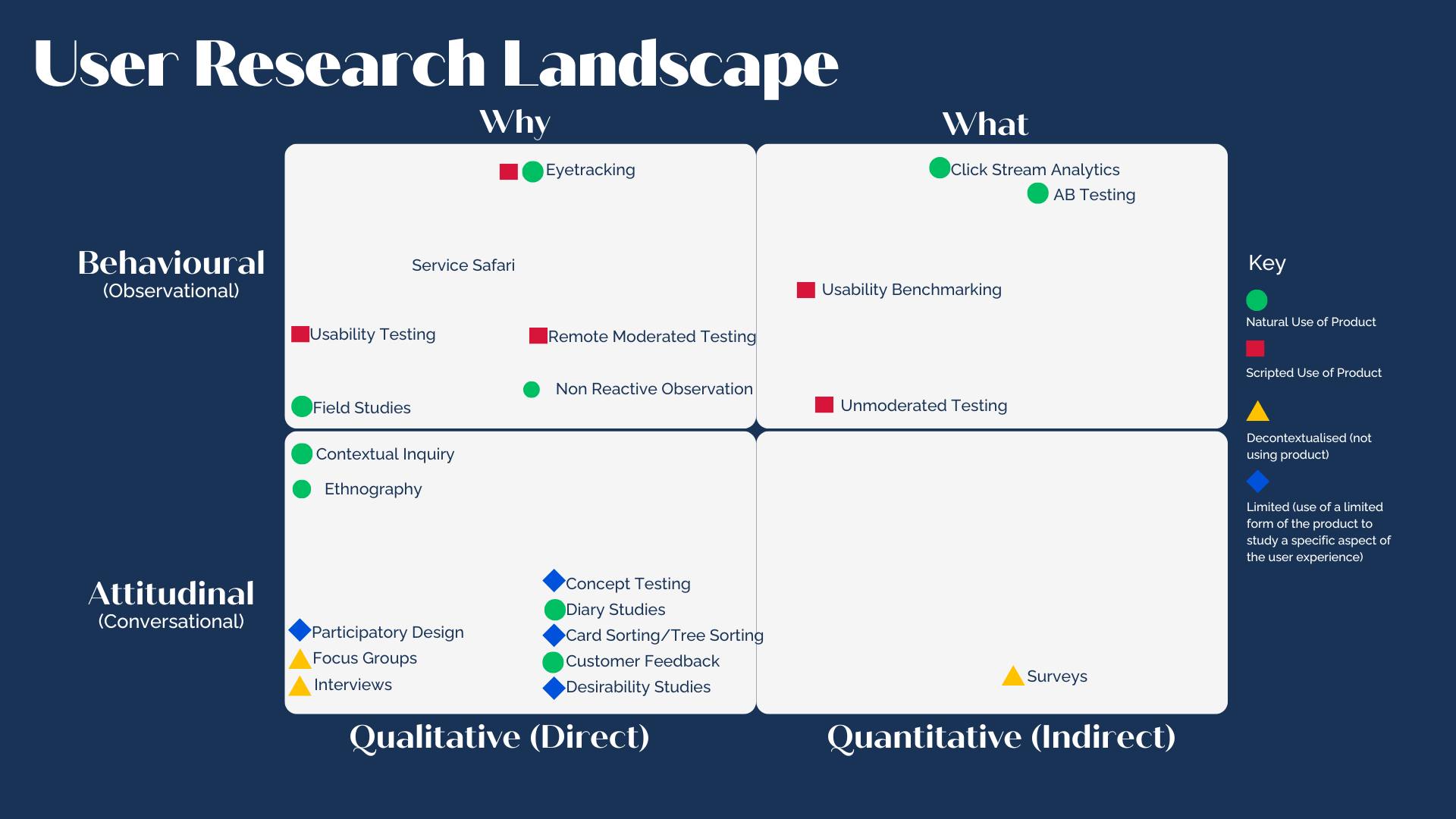

Different research questions require different research methods and the choice of methods should be dictated by the research objective and questions. In this section, you want to make sure to outline:

- The research methods you’ll use (e.g., interviews, surveys, usability tests, A/B tests)

- Break out why these methods are appropriate given the questions you are setting out to answer Utilise the below research landscape grid to help you identify what methods are appropriate.

- Identify the tools or platforms needed for the research such as Miro, UserTesting, Lookback, etc.

4. Participant Recruitment

Here you'll outline who you’ll be speaking with and how you’ll find them. As part of the research plan, you'll also detail how many participants you'll need and how you'll find and recruit these participants. Remember to focus on behaviours rather than just demographics.

- Target user personas (e.g., existing customers, new users, power users)

- Number of participants needed; depending on the type of research you are doing, eg a survey might be in the thousands, but interviews you might do 3-15.

- Recruitment methods (e.g., customer lists, third-party panels, intercept recruiting, internal panels)

- Incentives, if applicable and in some cases they are not; think government. Be conscious this could also lead to bias, so be careful about incentives.

5. Discussion Guide (or Research Script)

The discussion guide, or script is the document that you'll use to guide the research sessions and keep your discussion on track. You don't need to include it within your research plan, but you should at least provide a link to it The discussion guide outlines the structure of research sessions, ensuring consistency across participants or even across researchers if needed:

- Key questions to ask

- Probes and follow-ups

- Any materials used (e.g., prototypes, screens, card sorting exercises)

6. Data Analysis Plan

Not everyone includes an analysis section in the research plan, but it can be useful to have one whenever you plan to use collaborative analysis. That way, all stakeholders will be aware of where and when they will need to be involved. This will also help in terms of alignment around approach. Essentially you will outline how you're going to analyse the data.

- How data will be processed (e.g., thematic analysis, affinity mapping, p-test)

- Who will be involved in synthesis and when

- Tools for analysis, e.g., Dovetail, Excel, Notion

7. Timeline and Logistics

This section allows you to include your estimates on how long it will take you to complete all of the steps involved in the research project. Some methods can be super fast and when it comes to product specific research. I feel it should be. However, it can take way longer if you are doing something like a contextual inquiry into your customer segments. Break down when and how the research will be conducted:

- Estimated duration for each phase (recruitment, sessions, analysis)

- Research session logistics (remote or in-person, recording, translation needs)

- Key milestones and deadlines

8. Deliverables: What Will Be Shared?

Finally, specify how insights and outputs will be presented back to teams in organisations:

- Research report

- Live presentation to stakeholders

- Roadshow to organisation's other teams

- Video highlights or research clips

- A Miro board, pdf's or Notion doc summarizing finding

Best Practices for Effective Research Planning

Make sure to reach out and involve key stakeholders early; they too have deliverables to meet and it is always better to align than not. Take on being collaborative and partnering together; Product managers, engineers, designers, and leadership should all have input in shaping the research plan. Different roles are aware of and understand different things that are going on within the organisation, for the customer, for the product, strategically & technically and it pays to facilitate these conversations for debate. If you take the time to listen to different perspectives, your research, product, decision, etc will always be more robust. Doing this ensures their needs are addressed and they feel invested in the insights. It also ensures that the research is focusing on the right things that deliver on strategic goals.

Ensure that you keep It lightweight and actionable. A research plan doesn’t have to be a lengthy document, as clarity and alignment matter more than format and precision. Send it out to everyone early and often, to ensure you gather feedback from the get go. Focus on ensuring it answers the right questions and leads to actionable insights by making sure it aligns to the vision & strategic goals that the organisation has prioritised.

Something to consider, given everything that is going on with AI & Digital ID's & other concerning topics, is to prioritize ethics and data security. Make sure to have a discussion about these things at every step, from vision & strategy, to roadmaps and research. What are the impacts, should you do it, how do you measure that, how do you ensure data integrity and so much more. You want to ensure participant rights are protected with informed consent, anonymization, compliance to the privacy act, the GDPR and other legislation around the world, especially given our products have a more global nature to them nowadays. Make sure to be transparent about how data will be stored, used and disposed of. These are important considerations if you want to ensure you do not impact the rights of participants in a negative way.

Lastly, make sure to communicate findings effectively! I see a lot of organisations that when the research is done, they don't share this with all the teams, instead they keep it to themselves. Why, I don't know; I am sure they have many reasons, but good practice is to take that research and sing it widely to the rafters. Share it with all the teams in the organisation, but especially those product teams as its worth its weight in gold and should be shared and understood. You never know when these insights will be useful. Research should and does influence decisions, but make sure to tailor how you share findings. Always present in a professional manner, rather than ad-hoc and reactively. Create assets that can live and be reused & referenced by teams.. Learn to lean into and use storytelling, real quotes, and video snippets to make insights compelling. In turn, these assets can become part of your career portfolio, so taking the time now, makes a difference later on.

Final Thoughts

A research plan is more than just a document, it’s a tool for driving better product decisions. By deeply partnering with product managers and engineers, research becomes a collaborative effort rather than a siloed Design function. In being collaborative, it will tightly align to the strategic goals and hence the vision and is more likely to help identify a feasible solution earlier, as you have those conversations from the get go. The best teams treat research as an ongoing practice, not a one-off task. With a structured approach and cross-functional involvement, you’ll unlock deeper user insights, build better products, and create stronger alignment across your organization.

Are you ready to integrate research planning into your team’s workflow? Start by drafting your next research plan using the sections outlined above!